Contents:

You will receive the completely filled application form and other details on your registered email address. Next, you will receive your CLIENT-ID and Password after a day of registration with the instructions on how to log in. Ugadi, the Hindu festival will be commemorated this year on March 22. Also known as Yugadi, the day marks Andhra Pradesh’s New Year’s Day which embarks on the first day of the Hindu lunisolar calendar month of Chaitra. World Sparrow Day is celebrated across the world on 20 March to raise awareness about the conservation of sparrows. This day also celebrates the relationship between people and sparrows; spreads a love for sparrows, awareness about their importance in our lives, etc.

There are two types of long calendar spread – call and put. Put calendar spread offers certain advantages over call calendar spread. The general rule of thumb suggests executing put option when market outlook is bearish and call option when it is bullish. Another successful intraday trading strategy in India is the moving average crossover strategy.

Also you can calendar call spread a flag X no. of days before the expiration date. I use it at as marker to take off existing positions in expiration week or roll to next expiration date or to place new trades. It is a debit strategy wherein one is trying to exploit the faster time decay in current month. At the same time, same option is purchased in longer expiration for hedging to medicate the unlimited risk. Hence it is a risk defined strategy wherein the loss is limited.

In the case of an uptrend, experts recommend entering long positions or buying stocks. That said, when there’s a downtrend, traders enter short positions or sell their shares. This Long Strangle Strategy might be utilized when the trader anticipates high volatility in the underlying stock shortly. When an investor is bullish on volatility and bearish on the direction of the market, they must employ the Strip Strategy. Buying two lots of “At-the-Money Put Options” and “At-the-Money Call Options” are both parts of this strategy.

Buy GBPINR; target of : 93.30: ICICI Direct

The scalping trading strategy involves making financial gains from small price changes. This method is commonly used by intraday traders when buying and selling commodities. In addition, usually, individuals engaging in high-frequency trading utilize this technique.

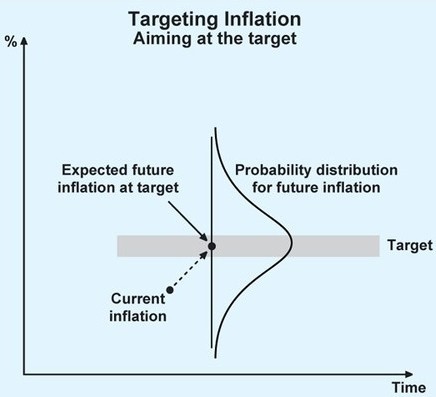

As an overview, we are going to do a non-directional calendar spread, i.e. we will not be predicting the markets. We will have the calendar spread with the market at the centre between two breakeven points. With the market in the centre can’t know whether it will move up or go down. With the two ranges set we will have the profits zone as shown with diagonal lines in the picture below. We will be adjusting our calendar spreads at one or two sides as the market moments. As the market moves up, we will be adjusting on the right side, and if it moves down, we will be adjusting on the left side of the spread.

My high IV observation and strategies (Elite+)

It is an annual commemoration of unborn fetuses and is observed as a day of opposition to abortion. The nine days of Chaitra Navratri this year will begin on March 22 and will end on March 30. Also, known as Rama Navratri, people worship different avatars of Goddess Durga for nine days and celebrate the birth of Lord Rama on the last day. One of the most celebrated Hindu holidays and an old Hindu custom is Holi. It honours the enduring and heavenly love of the Hindu deity Radha Krishna.

Then, if the stock moves upward between then and July expiry, the second leg will profit. Maximum profits from the Calendar Straddle are what we obtain when we trade the stocks at the strike price of the options sold during the expiration of the near term straddle. A trader buys a call option with a near-term expiration and sells a call option with a longer-term expiration on the same underlying stock. Here is how the reverse calendar spread will work in practice. Most spreads are constructed as a ratio spread with investments made in unequal proportions or ratios. A reverse calendar spread is normally the most profitable when markets make a huge move in either direction.

Options Trading: Calendar/ Time Spread Options Strategy – Axis Direct

The calendar spread strategy is largely insensitive to changes in the underlying asset’s price and volatility. This makes it a good choice for traders looking to trade in uncertain market conditions. Additionally, the strategy offers traders the flexibility to adjust or exit the spread before expiration to take advantage of changing market conditions or lock in profits. The concept of a reverse calendar spread is more popular when you trade on calendars in options. It entails buying a short-term option and selling a long-term option on the same underlying security with the same strike price.

- The investor will realise the maximum profit on this strategy when the stock price will either move above or below the strike price of the spread on the date of expiry.

- 2) If Nifty went to the strategy would lose money but how much?

- It is an annual commemoration of unborn fetuses and is observed as a day of opposition to abortion.

- The Break Even Point of Bear Call Spread is Lower Strike Price plus net premium received.

- The general rule of thumb suggests executing put option when market outlook is bearish and call option when it is bullish.

- Calendar call will be in profit if underlying stays between the breakeven point on expiry.

This strategy aims to benefit from the time decay of options and generate profit by taking advantage of the differences in the decay rates between the two options. This strategy is also known as a horizontal spread or a time spread. Traders use this strategy when market outlook is neutral, but also when traders expect gradual or sideways movements in short-time. Selling off short-term options and buying long-dated options result in an immediate net debit. To understand the profit-loss situation and identify a good time to exercise calendar spread, use Angel One trading tools or any other software that you deem fit.

The profits happen due to the effects happening due to time decay and also because there is a loss of time value for the near term options which is faster than the longer-term options. We can expect the profit from the rapid time decay experienced by the selling of the near term options. The maximum loss from this strategy cannot be defined completely. This is because it is highly dependent on the prices of the short call and since it bears the impact of volatility, anything is possible.

The September straddle would probably trade around 700, given that it would have moved down really fast. This position nets us Rs. 200 – which is only a Rs. 30 loss for our net payout of Rs. 230 earlier. Even if you went short on the puts at Rs. 60, the value of it just kept going down, and was fast heading to zero. This is because the downside didn’t continue fast enough – the nifty gyrated a lot; it rose to 7880 on Tuesday, fell back to 7791 on wednesday etc. But you can see that the trend in the put option was just down – a high implied volatility causes the option to decay very fast if the momentum subsides and that’s what happened. AP has been providing some excellent trading knowledge on the #options channel on Slack, and we’ve seen some incredible moves in recent times.

However, the risk involved by doing so will be very high. If the markets are strong, then we can be bitten by the market very harshly. In the case of the uncertainty of the underlying volatility, the trader should try to take the profit and carry on evaluating other possibilities of trading.

Like LongButterfly, Short Butterfly is also a 3 leg Strategy. When we sell single quantity of lower strike, buy double quantity of middle strike and sell single quantity of upper strike, it becomes ShortButterfly. It is having limited risk as well as limited returns profile. When we buy single quantity of lower strike, sell double quantity of middle strike and buy single quantity of upper strike, it becomes LongButterfly. Here you buy higher strike Call Option and Sell lower strike Call Option.

Upcoming Workshop Details

Reverse Calendar Spreads behave exactly opposite of Calendar Spreads. This is done by professionals when they think Volatility will decrease. Multiple leg orders are IOC orders, even if a single leg of the order does not execute or remains pending, the entire order will get canceled.

When it comes to https://1investing.in/ and selling securities on the same day, timing is undoubtedly one of the most crucial factors. This intraday trading strategy involves finding the stocks which have broken out of the territory in which they usually trade. The distinction between these two strike prices, less the total cost of the options, represents the maximum profit a trader can make using this strategy. A Roll Over is performed when a trader intends to carry his current month’s position to the next month. Similar to calendar spread order, rollover is performed on scrips/contracts of the same underlying. LongCondor is having limited risk and limited returns profile.

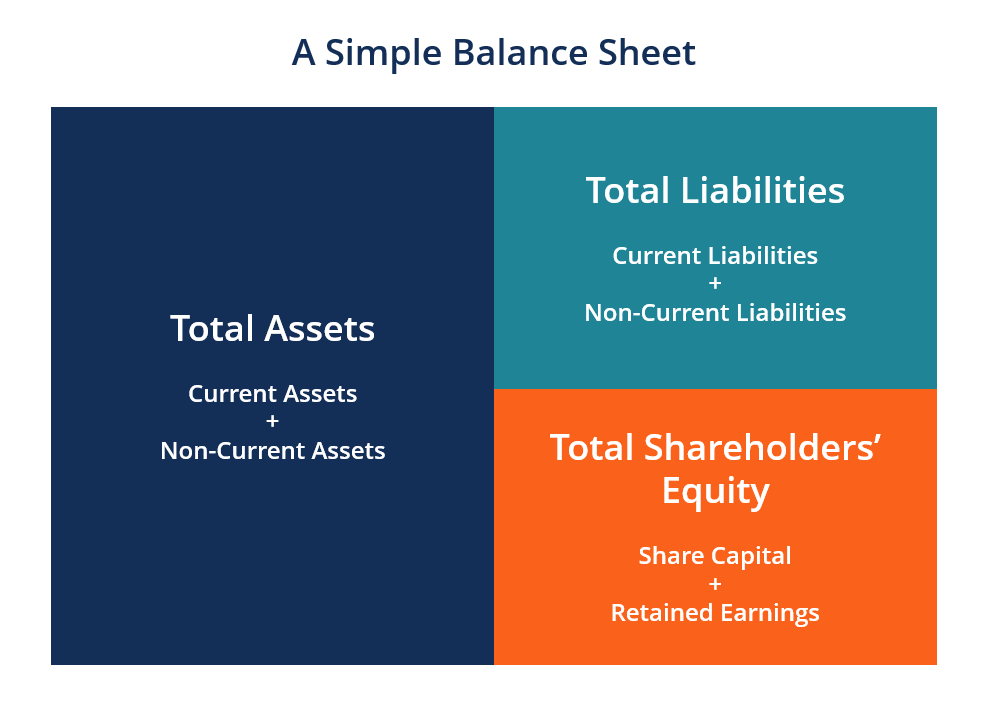

This strategy aims to profit from the time decay of options, where the value of an option decreases as it gets closer to expiration. The risk is limited to the net premium paid for establishing the spread, as the investor can only lose the initial investment. Note that in a calendar spread you are buying and selling the futures of the same stock but of contracts belonging to different expiries like in the case of Reliance Industries above.

MU Stock Climbs Off Lows Amid Earnings Optimism; Chip Leader … – Investor’s Business Daily

MU Stock Climbs Off Lows Amid Earnings Optimism; Chip Leader ….

Posted: Mon, 27 Mar 2023 11:30:00 GMT [source]

A bearish forecast is a right time to maintain a position in this strategy. If a significant change in the price of the underlying security occurs, then the values of the options will change as well. They are expected to fall drastically and more so, in the case of the longer term options. As a result of these positions, you will successfully create a short calendar call spread. The net credit spread resulting from these will be INR 200. On the other hand, the investor can choose a greater expiration date to sell the contracts.