Contents:

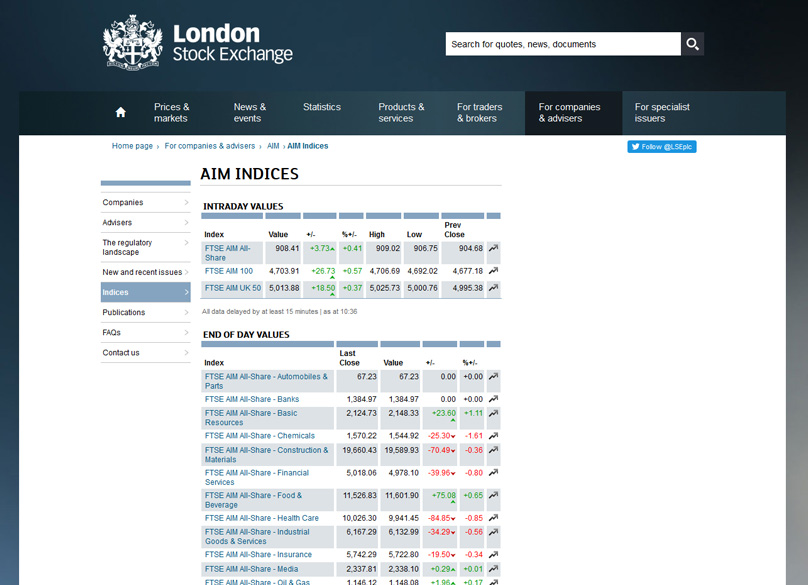

NEW YORK — call options learn the basics of buying and 2s of Powell Industries Inc. jumped 4% Monday after Sidoti & Co. upgraded its rating on the stock to buy from neutral. “Although we expect new orders in the oil and gas sector to remain weak … U.S. stocks traded lower, with the Dow Jones dropping over 200 points on Wednesday. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

Sign Up NowGet this delivered to your inbox, and more info about our products and services. SUP has an A grade for Growth and a B for Value and Sentiment. For the full-year 2023, the company expects its net sales to come between $1.55 billion and $1.67 billion. Its adjusted EBITDA is expected to come between $170 million and $200 million.

Powell Industries, Inc., together with its subsidiaries, designs, develops, manufactures, sells, and services custom-engineered equipment and systems for the distribution, control, and monitoring of electrical energy. It also provides value-added services, such as spare parts, field service inspection, installation, commissioning, modification and repair, retrofit and retrofill components for existing systems, and replacement circuit breakers for switchgear. The company has operations in the United States, Canada, the Middle East, Africa, Europe, Mexico, and Central and South America.

Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Powell Industries declared a quarterly dividend on Tuesday, January 31st.

Powell Industries Estimates* in USD

POWL designs, develops, manufactures, sells, and services custom-engineered equipment and systems to distribute, control, and monitor electrical energy. The company’s principal products include integrated power control room substations, electrical houses, medium-voltage circuit breakers, and motor control centers. Powell Industries Inc is a United States-based company that develops, designs, manufactures, and services custom-engineered equipment and systems for electrical energy distribution, control, and monitoring. The company’s principal products comprise integrated power control room substations, custom-engineered modules, electrical houses, traditional and arc-resistant distribution switchgear and control gear, and so on.

CAT: Looking for Big Gains in 2023? Try These 2 Industrial Stocks – StockNews.com

CAT: Looking for Big Gains in 2023? Try These 2 Industrial Stocks.

Posted: Wed, 28 Dec 2022 18:23:00 GMT [source]

Brett Cope has an approval rating of 73% among the company’s employees. Sign-up to receive the latest news and ratings for Powell Industries and its competitors with MarketBeat’s FREE daily newsletter. The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s.

Key Stock Data

https://1investing.in/ Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

The Company distributes, controls and monitors the flow of electrical energy and provides protection to motors, transformers and other electrically powered equipment. Its principal products include integrated power control room substations , custom-engineered modules, electrical houses (E-Houses), traditional and arc-resistant distribution switchgear and control… Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. 1 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for Powell Industries in the last twelve months.

Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. LONDON — Powell Industries Inc. said Wednesday that its fiscal fourth-quarter net profit jumped to $8.3 million, or 72 cents a share, from $2.5 million, or 22 cents a share, a year earlier. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity.

Powell Industries Shareholder

Against this backdrop, fundamentally strong stocks MOD, POWL, and SUP could be solid buys now. 52 week low is the lowest price of a stock in the past 52 weeks, or one year. Powell Industries, Inc. 52 week low is $18.87 as of April 29, 2023. 52 week high is the highest price of a stock in the past 52 weeks, or one year. Powell Industries, Inc. 52 week high is $47.46 as of April 29, 2023. We’d like to share more about how we work and what drives our day-to-day business.

To see all exchange delays and terms of use please see Barchart’s disclaimer. Powell Industries’ stock is owned by many different institutional and retail investors. 27 employees have rated Powell Industries Chief Executive Officer Brett Cope on Glassdoor.com.

It stands for Earnings before Interest, Taxes, Depreciation, and Amortization. It attempts to reflect the cash profit generated by a company’s operations. Powell Industries reported Q4 EPS of $0.73, $0.54 better than the analyst estimate of $0.19.

POWELL INDUSTRIES ANNOUNCES DATE AND CONFERENCE CALL FOR FISCAL 2023 SECOND QUARTER RESULTS

It’s calculated by dividing the current share price by the earnings per share . It can also be calculated by dividing the company’s Market Cap by the Net Profit. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Net income came in at $1.16 million compared to the prior-year quarter net loss of $2.85 million, while its earnings per share came in at $0.10, from the year-ago quarter loss per share of $0.24. Announced that its board of directors had approved a 1% increase to the quarterly dividend on its common stock to $0.2625 per share, equating to an annualized dividend of $1.05 per share. Which accounts for 10.7% of the total Gross Domestic Product of the United States, was marred by several macroeconomic factors, such as high prices, increasing interest rates, and regional banking collapses. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

Powell Industries Stock Forecast, Price & News (NASDAQ:POWL) – MarketBeat

Powell Industries Stock Forecast, Price & News (NASDAQ:POWL).

Posted: Fri, 12 Aug 2016 08:51:52 GMT [source]

Additionally, POWL topped consensus EPS estimates in three of the four trailing quarters and revenue estimates in all of the trailing four quarters. Price/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations. Historical valuations generally do not reflect a company’s current market value. Value investors frequently look for companies that have low price/book ratios. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends.

POWL’s revenues increased 19% year-over-year to $126.86 million in the fiscal first quarter that ended December 31, 2022. The company’s operating income is $1.09 million for the same quarter compared to a negative $4.29 million for the quarter that ended December 31, 2021. The 50-day moving average is a frequently used data point by active investors and traders to understand the trend of a stock. It’s calculated by averaging the closing stock price over the previous 50 trading days. The Price-to-Earnings (or P/E) ratio is a commonly used tool for valuing a company.

MOD – Despite several macroeconomic headwinds, the manufacturing sector is anticipated to remain firm and witness significant growth, thanks to technological advancements and lucrative government investments. Given this backdrop, quality stocks Modine Manufacturing , Powell Industries , and Superior Industries International could be worth buying right now. Provide specific products and services to you, such as portfolio management or data aggregation. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023.

It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. MOD shares were trading at $20.72 per share on Thursday morning, up $0.02 (+0.10%). Year-to-date, MOD has gained 4.33%, versus a 7.17% rise in the benchmark S&P 500 index during the same period. Its adjusted EBITDA increased 53.7% year-over-year to $57.50 million. Additionally, its earnings per share came in at $0.25, compared to the loss per share of $0.48 in the prior-year quarter.

The company’s net income came in at $16.50 million, compared to a net loss of $3.90 million in the year-ago quarter. MOD’s revenue for the fiscal first quarter ending June 2023 is expected to increase 5.7% year-over-year to $571.77 million. Its EPS for the same quarter is expected to increase 43.8% year-over-year to $0.46. It surpassed its consensus EPS estimates in each of the trailing four quarters, which is impressive.

ComparePOWL’s historical performanceagainst its industry peers and the overall market. Forward P/E gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated. POWL has a forward dividend yield of 2.62%.SeePOWL’s full dividends and stock split historyon the Dividend tab.

NewsPowell Industries Inc.POWL

Powell Industries’ stock was trading at $35.18 at the start of the year. Since then, POWL shares have increased by 13.9% and is now trading at $40.06. Represents the company’s profit divided by the outstanding shares of its common stock. SUP’s revenue for the fiscal second quarter ending June 2023 is expected to increase 2% year-over-year to $440.07 million. Its EPS for the same quarter is expected to increase 71.4% year-over-year to $0.12. Moreover, SUP has topped consensus EPS and revenue estimates in three of the four trailing quarters.

- The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades.

- Powell Industries, Inc. engages in the development, design, manufacture and provision of services of custom-engineered products and systems.

- Price/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations.

The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Highlights of the biggest gainers and decliners in the U.S. stock market on Wednesday.