Contents:

This means companies with supercharged dividend yields require some extra vetting by investors. When things become uncertain on Wall Street, investors tend to turn to the safety provided by dividend stocks. Publicly traded companies that pay a regular dividend are usually profitable, have well-defined long-term growth outlooks, and are time-tested. Best of all, income stocks have historically crushed their non-paying peers in the return column over the long run. And with the company’s dividend payout ratio forecasted to clock in at around 36% for the current fiscal year, superb dividend growth should persist moving forward.

- Dividends are often expected by the shareholders as a reward for their investment in a company.

- However, before the investors decide to look at the dividend yield, they need to look at the records of the company.

- They both consult a financial consultant, who informs them that usually, when a company pays more dividend yield, the company’s growth potential is not that good, and vice versa.

- 3M’s profits are also trending lower, with adjusted earnings per share down 25% in the first quarter.

- It is one of the most important metrics in deciding whether an investment into the share will result in the expected returns.

- The cash flow earned from such business activities determines its profits, which gets reflected in the company’s stock prices.

The money might be better used by reinvesting into the company to grow the business. As we spring forward into a new month, three ultra-high-yield dividend stocks stand out as ripe for the picking. The following income stocks, with yields ranging from 8.4% to 13.4%, can all be bought hand over fist in May. These high-octane dividend stocks, with yields ranging from 8.4% to 13.4%, are begging to be bought by opportunistic income seekers. The company’s diluted earnings per share soared 17.2% year over year to $2.93 for the fiscal first quarter.

Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. In this case, we can see that Company A is a more attractive option for John. Company A is an older and more established company that is able to sustain a stable dividend distribution to its investors.

Even with dividends well above the market average, these stocks may not be right for all investors.

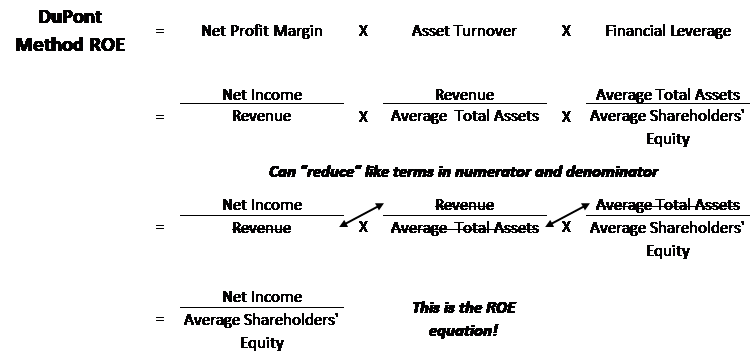

Dividends are not the only way companies can return value to shareholders; therefore, the payout ratio does not always provide a complete picture. The augmented payout ratio incorporates sharebuybacksinto the metric; it is calculated by dividing the sum of dividends and buybacks by net income for the same period. If the result is too high, it can indicate an emphasis on short-term boosts to share prices at the expense of reinvestment and long-term growth. The dividend payout ratio is one way to assess the strength of a company’s dividends. The calculation for a payout ratio is to divide dividend by net income and then multiply the sum by 100. When the payout ratio is lower, it is preferable as the company will be disbursing less of its net income to shareholder dividend payments.

United Rentals Becomes Oversold – Nasdaq

United Rentals Becomes Oversold.

Posted: Thu, 04 May 2023 19:55:00 GMT [source]

The good news is that things would have to go very wrong for AT&T for any real pressure to be put on the dividend. Assuming the company hits its $16 billion FCF target, the dividend will consume just over half of that total this year. It’s been a rough year for life insurance and retirement services company Lincoln National, with the company shares falling more than 30% year to date. The reduced share price is largely why the company’s dividend yield is so high.

Calculating dividends per share

For investors, the dividend per share is the easiest method to calculate the expected dividend payment amount the company will be giving. Lower Dividend per share doesn’t mean that there is no growth potential for the company. For analyzing the growth potential of any company, we need to calculate the financial ratios and the dividend yield. The cash flow earned from such business activities determines its profits, which gets reflected in the company’s stock prices. Companies also make dividend payments to stockholders, which usually originates from business profits. The DDM model is based on the theory that the value of a company is the present worth of the sum of all of its future dividend payments.

The formula used for dividend yield is the simplest, and any novice can understand how to calculate it. The dividend yield formula is one of the essential metrics to assess the outcome of an investment. Other – other, less common, types of financial assets can be paid out as dividends, such as options, warrants, shares in a new spin-out company, etc. Special – a special dividend is one that’s paid outside of a company’s regular policy (i.e., quarterly, annual, etc.).

- (Money spent this way is called “retained earnings.”) Alternatively, it can use its profits to pay its investors.

- First, we need to ascertain the company’s net profit for the report date, March 2017.

- Interim dividend is declared before the accounts are prepared for the ongoing financial year.

- The formula used for dividend yield is the simplest, and any novice can understand how to calculate it.

- Therefore, the company maintained a dividend payout ratio of 0.2 during the year 20XX.

- We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

This ratio can tell how much dividend was earned by owning the stocks of that particular company over a period of time. Dividend per share is the total amount of dividends issued to the shareholders for every share of equity stock by the company. Alternatively, if one spot a certain trend—like a company making dividend payments of $2.00, $2.50, $3.00 and $3.50 over the last four years—then an assumption can be made about this year’s payment being $4.00. The earnings of the company are instead reinvested to help fund further growth.

The cost of equity is the rate of return required on an investment in equity or for a particular project or investment. A steadily rising ratio could indicate a healthy, maturing business, but a spiking one could mean the dividend is heading into unsustainable territory. Dividend irrelevance theory holds the belief that dividends don’t have any effect on a company’s stock price. Common shareholders of dividend-paying companies are eligible to receive a distribution as long as they own the stock before the ex-dividend date.

Understanding the Dividend Yield

Since it implies that a company has moved past its initial growth stage, a high payout ratio means share prices are unlikely to appreciate rapidly. Tax is another important consideration when investing in dividend gains. Investors in high tax brackets often prefer dividend-paying stocks if their jurisdiction allows zero or comparatively lower tax on dividends.

X got pretty happy since he is getting a lot more than what he paid for each share. However, Y got a bit sad to see that her dividend yield – stock is only a meager percentage. Dividend per share is the total dividends declared in a period divided by the number of outstanding ordinary shares issued. The dividend rate is an estimate of the dividend-onlyreturnof an investment such as on a stock or mutual fund.

Forbes Advisor India studied listed companies in India to evaluate which ones are the best dividend paying stocks and why they should be considered for investment. Earnings per share is a metric used to assess a company’s profitability. It is determined by dividing net profit by total number of outstanding shares. A company may pay dividends in various forms, but these are the most prominent ones. Even if you put it in the formula, the total number of outstanding shares cancel out. Terminal value determines the value of a business or project beyond the forecast period when future cash flows can be estimated.

Thus, if you’re using past dividend values to estimate what you’ll be paid in the future, there’s a chance that your calculation may not be accurate. When a company pays a dividend it is not considered an expense since it is a payment made to the company’s shareholders. This differentiates it from a payment for a service to a third-party vendor, which would be considered a company expense. A dividend is a distribution of earnings, often quarterly, by a company to its shareholders in the form of cash or stock reinvestment. Investors should exercise caution when evaluating a company that looks distressed and has a higher-than-average dividend yield.

Dividend Definition

Add in a rock-bottom valuation — AT&T is valued at less than 8 times forward FCF — and you have a compelling dividend stock that has the potential to beat the market. Pioneer Natural Resources is an Irving, Texas-based oil and natural gas exploration and production company. Unlike most dividend-paying companies, Pioneer Natural Resources has a set dividend and then a variable dividend based on the company’s free cash flow.

Cabot Enters Oversold Territory – Nasdaq

Cabot Enters Oversold Territory.

Posted: Thu, 04 May 2023 15:34:00 GMT [source]

Investing in businesses with well-known brands and products that are in high demand tends to work out well over the long run. This is because such companies often have at least some level of pricing power, which leads to revenue growth, earnings growth, share price growth, and last but not least dividend growth. All five listed stocks have admirable dividend yields, but looking at their total returns can give more perspective. The company pays 75% of its free cash flow out in the variable dividend, so its yield is high largely due to the high profits energy companies have had over the past year and a half or so.

If there are treasury shares, it is important to subtract those from the number of issued shares to get the number of outstanding shares. A company endures a bad year without suspending payouts, and it is often in their interest to do so. It is therefore important to consider future earnings expectations and calculate a forward-looking payout ratio to contextualize the backward-looking one. Dividends are often expected by the shareholders as a reward for their investment in a company.

If a company pays out some of its earnings as dividends, the remaining portion is retained by the business—to measure the level of earnings retained, the retention ratio is calculated. However, a reduction in dividend amounts or a decision against a dividend payment may not necessarily translate into bad news for a company. The company’s management may have a plan for investing the money such as a high-return project that has the potential to magnify returns for shareholders in the long run.

If a company is giving regular dividends one may very easily conclude that the company is performing well as dividends would not be possible otherwise. Hence investors can keep their money invested and enjoy a regular income. Dividend stocks are the ones that are known to provide regular dividends to their shareholders. Though there is no compulsion on any company to issue dividends, it is just an unspoken understanding between the shareholders and company management. It can be applied to GDP, corporate revenue, or an investment portfolio.

Analysts and investors may make certain assumptions, or try to identify trends based on past dividend payment history to estimate future dividends. In their financial statements is a section that outlines the dividends declared per common share. For easy reference, you can compare the dividends to the net earnings per share in the same period. The number of shares outstanding can typically be found on the company’s balance sheet.

Still no budget deal as session winds down – Alaska Landmine

Still no budget deal as session winds down.

Posted: Fri, 05 May 2023 06:36:00 GMT [source]

This rate of return is represented by and can be estimated using theCapital Asset Pricing Model or the Dividend Growth Model. However, this rate of return can be realized only when an investor sells his shares. Currently, there are 10 million shares issued with 3 million shares in the treasury. The company liquidates all its assets and pays the sum to shareholders as a dividend. Liquidating dividends are usually issued when the company is about to shut down.

The dividend payout ratio provides an indication of how much money a company is returning to shareholders versus how much it is keeping on hand to reinvest in growth, pay off debt, or add to cash reserves . Retail giant Walgreens Boots Alliance , the largest retail pharmacy in both the United States and Europe, stands out as a top dividend aristocrat. Its pharmacy business performed well, with 5.2% comparable sales growth and 5.9% comparable prescription growth. Given the company’s history of outperformance, analysts predict 8%-10% annualized growth in earnings per share, over the next several years. Furthermore, returns will likely be boosted by Walgreens’s 3.93% dividend yield, as well as a rising valuation. Companies that pay dividends often prefer to maintain or slowly grow their dividend rates as a demonstration of stability and to reward shareholders.

Calculating the dividend growth rate is necessary for using a dividend discount model for valuing stocks. Outstanding Stock at the beginning was 4000 and Outstanding stock at the end it was 6000. We have to calculate the dividend per share of Anand Group of a company. The dividend growth rate is the annualized percentage rate of growth of a particular stock’s dividend over time. For example, if a company has paid a dividend of $1 per share this year and is expected to maintain a 5% growth rate for dividend payment, the next year’s dividend is expected to be $1.05.

Q.3. A man bought \(500\) shares, each of face value \(₹10\), of a certain business concern and during the first year after purchase received \(₹400\) as dividend on his shares. Depending on the company’s performance and profits, the market value of a share can be the same, higher, or less than its nominal value. In this article, we are going to discuss the definition and formula of dividends. One of the most exciting catalysts is having parent Antero Resources increase drilling on Antero Midstream-owned acreage. With the infrastructure already in place to support an uptick in drilling, Antero Midstream anticipates that will feature a reduction in capital expenditures and an uptick in free-cash-flow generation. Not surprisingly, the company’s first-quarter operating results featured a decrease in full-year capex and an increase in net income and free-cash-flow guidance.

A dividend is an amount that a publicly listed company gives out to its shareholders for every share they hold. The rate of dividend to be paid is decided by the company’s board of directors. The annual dividend is the total amount of dividend paid to the shareholders for holding each share of the company, it is paid out at the end of the financial year. The most common and straightforward calculation of a DDM is known as the Gordon growth model , which assumes a stable dividend growth rate and was named in the 1960s after American economist Myron J. Gordon.

Because https://1investing.in/ yields change relative to the stock price, it can often look unusually high for stocks that are falling in value quickly. Dividend YieldDividend yield ratio is the ratio of a company’s current dividend to its current share price. Let us take the example of a company named ASD Ltd that has achieved net sales of $400,000 during last year. The company managed a net profit margin of 12% and historically they are known to distribute 30% of the net earnings to the shareholders in the form of dividends.

Tobacco giant Altria Group has one of the world’s most iconic brands, Marlboro, to thank for a lot of its success. Although Marlboro cigarette sales pad the what is the formula of dividend‘s bottom line, there isn’t much room for growth in the tobacco category, especially in the U.S. This potential lack of growth is why the company has such a hefty dividend. The steep life insurance loss may rightfully worry investors about Lincoln National’s ability to maintain its dividend, so that’s something to keep an eye on because investors may decide to jump ship. Still, Devon Energy has outperformed the other stocks on this list in the past few years by a considerable margin. Here is some information about the five companies to help you decide if investing in them is right for you.