Content

It is a category of accrual under which the company receives cash before it provides goods or renders services. Under this, the exchange happens before actual goods or service delivery, and as such, no revenue is recorded by the company. The company, however, is under an obligation to provide the goods or render the service, as the case may be, on due dates for which advance payment has been received by it.

- Businesses can profit greatly from unearned revenue as customers pay in advance to receive their products or services.

- The company would record the $100 as unearned revenue on its balance sheet.

- However, those wondering “is unearned revenue a liability in the long-term” could also be proven correct when looking at a service that will take longer than a year to deliver.

- As the product or service is delivered over time, this liability becomes revenue on the income statement.

For example, imagine that a customer purchases an annual subscription for a streaming music service. This would initially be marked as unearned service revenue because the https://www.bookstime.com/articles/suspense-account company has received a full payment for services not yet provided. The full $50 would need to be recorded as unearned service revenue on the company’s balance sheet.

When is income or revenue earned?

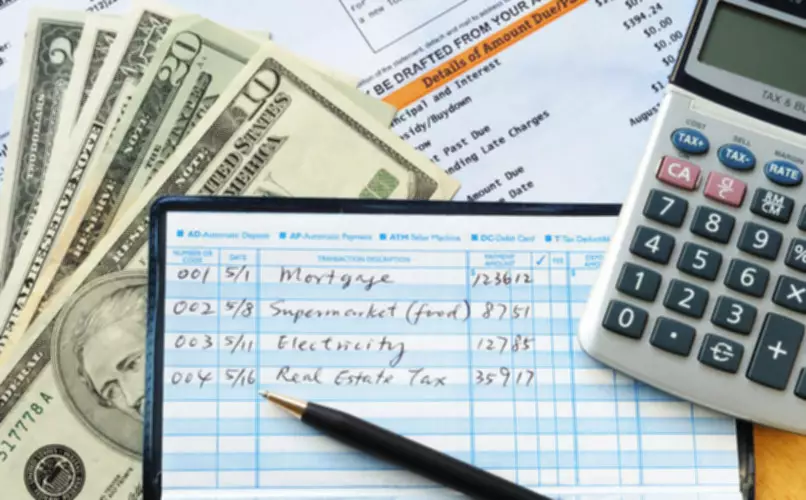

For annual contracts, a prepayment is made at the beginning of the period. A business then would perform the service monthly and recognize a certain amount of revenue each month. With the provider and customer agreeing to delivery of a services or goods, at a specified time, for a specified price.

Where is unearned revenue on balance sheet?

Unearned revenue is listed under “current liabilities.” It is part of the total current liabilities as well as total liabilities. On a balance sheet, assets must always equal equity plus liabilities.

Due to the revenue recognition process, cash flow and income are not inherently linked. You can have deferred revenue on the cash flow statement without income, you can also have income without inflows of cash. An easy way to understand deferred revenue is to think of it as a debt owed to a customer. Unearned revenue must be earned via the distribution of what the customer paid for and not before that transaction is complete. By delivering the goods or service to the customer, a company can now credit this as revenue. A variation on the revenue recognition approach noted in the preceding example is to recognize unearned revenue when there is evidence of actual usage.

Deferred revenue examples

Unearned revenue represents money that has been paid by a customer, but which has not yet been delivered. This money is typically held in escrow until the work is completed, at which point it is transferred to the company’s bank account. Smaller companies are more likely to use the cash accounting method. Companies that use cash accounting don’t use unearned revenue or follow GAAP.

- The company decreases the balances in the unearned revenue account and increases the balance in the revenue account, as the revenue is earned by the company.

- Where unearned revenue on the balance sheet is not a line item, you will credit liabilities.

- It is then understated for the additional periods during which the revenue and profits should have been recognized.

- It’s common for insurers to take payment in advance for all kinds of insurance products — such as home, auto, and life insurance.

- Determining the value of operating activities for a business’s cash flow statement is an important part of preparing the disclosures a business needs to make to its investors.

Unearned revenue is a liability because there is a chance of a refund. Remember revenue is only recognized if a service or product is delivered, a refund nulls recognition. A reversal, will adjust the liability and move the money through to income, do NOT do that.

Introduction to Business

The company, after receiving the cancellation request from the customer, canceled the order and refunded the amount back to Y. Media companies like magazine publishers often generate unearned revenue as a result of their business models. For example, the publisher needs the cash flow to produce content through its various teams, market the content compelling to reach its audience, and print and distribute issues upon publication. Each activity in a publisher’s business strategy can benefit from the resulting cash flow of unearned revenue.

Fulfill customer obligations in a timely and efficient manner to maintain customer satisfaction and build trust. This will help reduce the risk of disputes or cancellations and foster long-term customer relationships. It is the seller’s choice to prorate the refund or to charge additional fees. Not all companies have to comply with the specific requirements of ASC 606. But it is highly recommended for businesses working toward becoming a public company or attracting serious investors. For items like these, a customer pays outright before the revenue-producing event occurs.

Models in Software Development That Businesses Should Know

Instead, you will record the payment as a liability on your balance sheet. They’re usually salaries payable, expense payable, short term loans is unearned revenue a current liability etc.read more. However, if the unearned is not expected to be realized as actual sales, then it can be reported as a long-term liability.